The award-winning WIRED UK Podcast with James Temperton and the rest of the team. Listen every week for the an informed and entertaining rundown of latest technology, science, business and culture news. New episodes every Friday.

…

continue reading

LessWrong에서 제공하는 콘텐츠입니다. 에피소드, 그래픽, 팟캐스트 설명을 포함한 모든 팟캐스트 콘텐츠는 LessWrong 또는 해당 팟캐스트 플랫폼 파트너가 직접 업로드하고 제공합니다. 누군가가 귀하의 허락 없이 귀하의 저작물을 사용하고 있다고 생각되는 경우 여기에 설명된 절차를 따르실 수 있습니다 https://ko.player.fm/legal.

Player FM -팟 캐스트 앱

Player FM 앱으로 오프라인으로 전환하세요!

Player FM 앱으로 오프라인으로 전환하세요!

“Where is the Capital? An Overview” by johnswentworth

Manage episode 519990485 series 3364760

LessWrong에서 제공하는 콘텐츠입니다. 에피소드, 그래픽, 팟캐스트 설명을 포함한 모든 팟캐스트 콘텐츠는 LessWrong 또는 해당 팟캐스트 플랫폼 파트너가 직접 업로드하고 제공합니다. 누군가가 귀하의 허락 없이 귀하의 저작물을 사용하고 있다고 생각되는 경우 여기에 설명된 절차를 따르실 수 있습니다 https://ko.player.fm/legal.

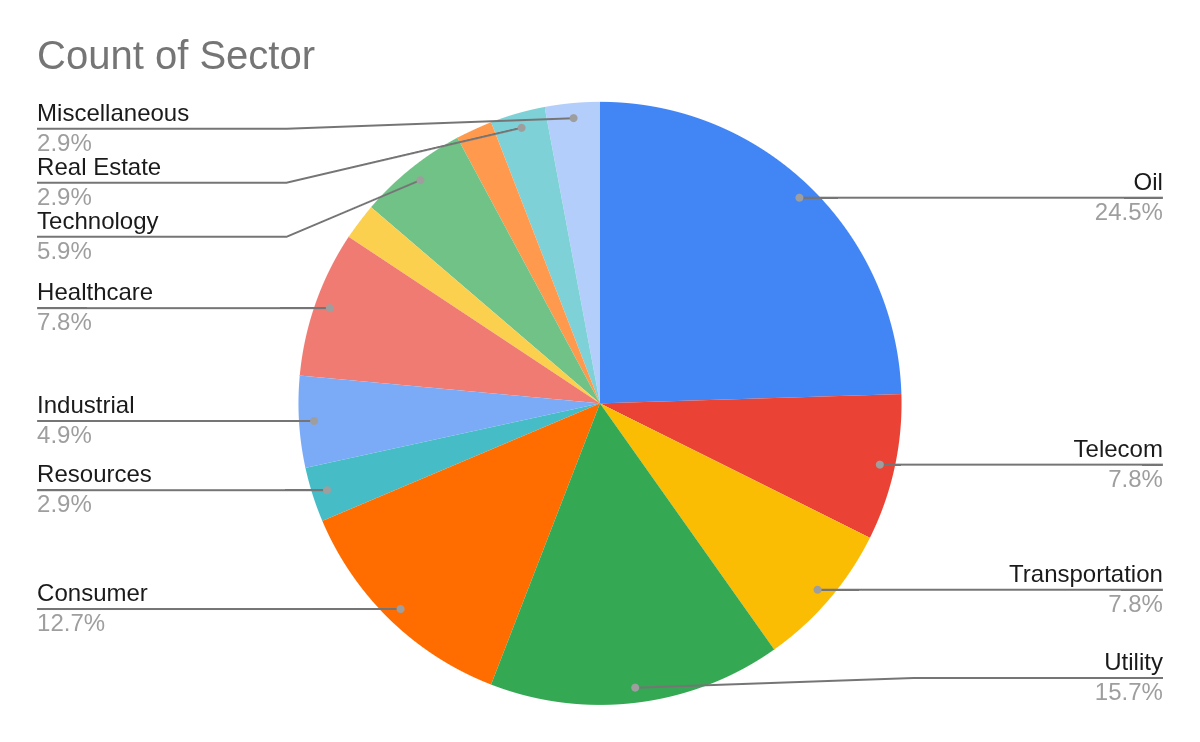

When a new dollar goes into the capital markets, after being bundled and securitized and lent several times over, where does it end up? When society's total savings increase, what capital assets do those savings end up invested in?

When economists talk about “capital assets”, they mean things like roads, buildings and machines. When I read through a company's annual reports, lots of their assets are instead things like stocks and bonds, short-term debt, and other “financial” assets - i.e. claims on other people's stuff. In theory, for every financial asset, there's a financial liability somewhere. For every bond asset, there's some payer for whom that bond is a liability. Across the economy, they all add up to zero. What's left is the economists’ notion of capital, the nonfinancial assets: the roads, buildings, machines and so forth.

Very roughly speaking, when there's a net increase in savings, that's where it has to end up - in the nonfinancial assets.

I wanted to get a more tangible sense of what nonfinancial assets look like, of where my savings are going in the physical world. So, back in 2017 I pulled fundamentals data on ~2100 publicly-held US companies. I looked at [...]

---

Outline:

(02:01) Disclaimers

(04:10) Overview (With Numbers!)

(05:01) Oil - 25%

(06:26) Power Grid - 16%

(07:07) Consumer - 13%

(08:12) Telecoms - 8%

(09:26) Railroads - 8%

(10:47) Healthcare - 8%

(12:03) Tech - 6%

(12:51) Industrial - 5%

(13:49) Mining - 3%

(14:34) Real Estate - 3%

(14:49) Automotive - 2%

(15:32) Logistics - 1%

(16:12) Miscellaneous

(16:55) Learnings

---

First published:

November 16th, 2025

Source:

https://www.lesswrong.com/posts/HpBhpRQCFLX9tx62Z/where-is-the-capital-an-overview

---

Narrated by TYPE III AUDIO.

---

…

continue reading

When economists talk about “capital assets”, they mean things like roads, buildings and machines. When I read through a company's annual reports, lots of their assets are instead things like stocks and bonds, short-term debt, and other “financial” assets - i.e. claims on other people's stuff. In theory, for every financial asset, there's a financial liability somewhere. For every bond asset, there's some payer for whom that bond is a liability. Across the economy, they all add up to zero. What's left is the economists’ notion of capital, the nonfinancial assets: the roads, buildings, machines and so forth.

Very roughly speaking, when there's a net increase in savings, that's where it has to end up - in the nonfinancial assets.

I wanted to get a more tangible sense of what nonfinancial assets look like, of where my savings are going in the physical world. So, back in 2017 I pulled fundamentals data on ~2100 publicly-held US companies. I looked at [...]

---

Outline:

(02:01) Disclaimers

(04:10) Overview (With Numbers!)

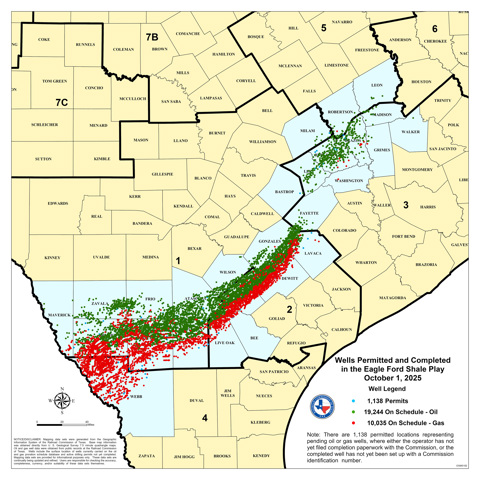

(05:01) Oil - 25%

(06:26) Power Grid - 16%

(07:07) Consumer - 13%

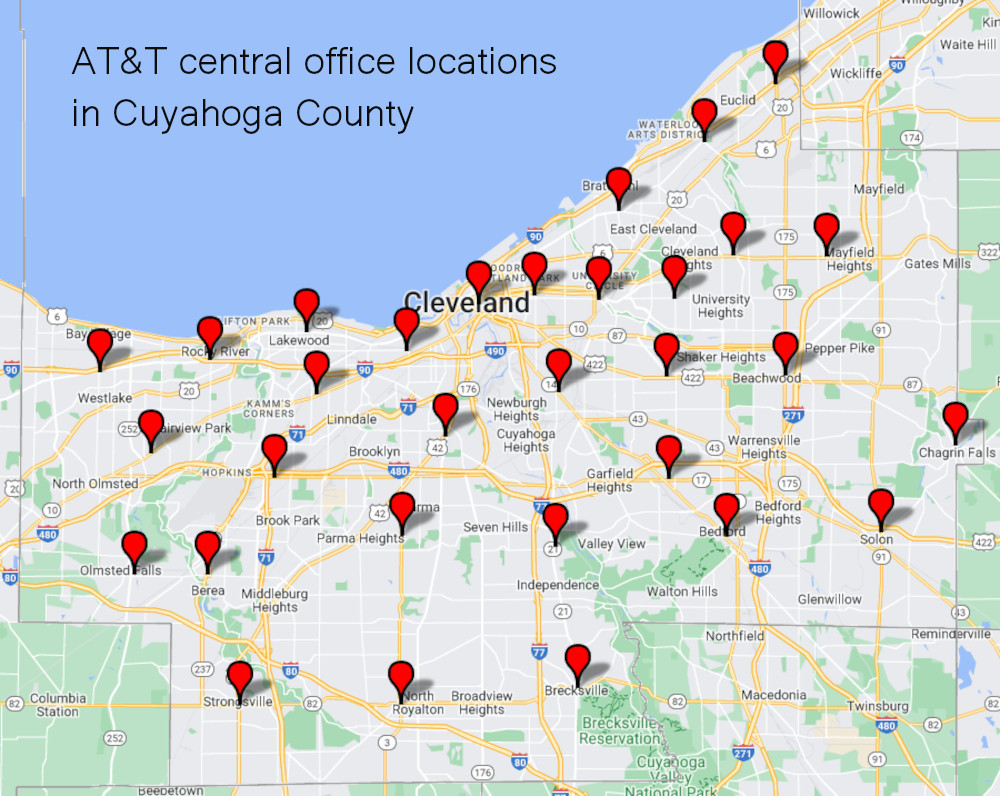

(08:12) Telecoms - 8%

(09:26) Railroads - 8%

(10:47) Healthcare - 8%

(12:03) Tech - 6%

(12:51) Industrial - 5%

(13:49) Mining - 3%

(14:34) Real Estate - 3%

(14:49) Automotive - 2%

(15:32) Logistics - 1%

(16:12) Miscellaneous

(16:55) Learnings

---

First published:

November 16th, 2025

Source:

https://www.lesswrong.com/posts/HpBhpRQCFLX9tx62Z/where-is-the-capital-an-overview

---

Narrated by TYPE III AUDIO.

---

680 에피소드

Manage episode 519990485 series 3364760

LessWrong에서 제공하는 콘텐츠입니다. 에피소드, 그래픽, 팟캐스트 설명을 포함한 모든 팟캐스트 콘텐츠는 LessWrong 또는 해당 팟캐스트 플랫폼 파트너가 직접 업로드하고 제공합니다. 누군가가 귀하의 허락 없이 귀하의 저작물을 사용하고 있다고 생각되는 경우 여기에 설명된 절차를 따르실 수 있습니다 https://ko.player.fm/legal.

When a new dollar goes into the capital markets, after being bundled and securitized and lent several times over, where does it end up? When society's total savings increase, what capital assets do those savings end up invested in?

When economists talk about “capital assets”, they mean things like roads, buildings and machines. When I read through a company's annual reports, lots of their assets are instead things like stocks and bonds, short-term debt, and other “financial” assets - i.e. claims on other people's stuff. In theory, for every financial asset, there's a financial liability somewhere. For every bond asset, there's some payer for whom that bond is a liability. Across the economy, they all add up to zero. What's left is the economists’ notion of capital, the nonfinancial assets: the roads, buildings, machines and so forth.

Very roughly speaking, when there's a net increase in savings, that's where it has to end up - in the nonfinancial assets.

I wanted to get a more tangible sense of what nonfinancial assets look like, of where my savings are going in the physical world. So, back in 2017 I pulled fundamentals data on ~2100 publicly-held US companies. I looked at [...]

---

Outline:

(02:01) Disclaimers

(04:10) Overview (With Numbers!)

(05:01) Oil - 25%

(06:26) Power Grid - 16%

(07:07) Consumer - 13%

(08:12) Telecoms - 8%

(09:26) Railroads - 8%

(10:47) Healthcare - 8%

(12:03) Tech - 6%

(12:51) Industrial - 5%

(13:49) Mining - 3%

(14:34) Real Estate - 3%

(14:49) Automotive - 2%

(15:32) Logistics - 1%

(16:12) Miscellaneous

(16:55) Learnings

---

First published:

November 16th, 2025

Source:

https://www.lesswrong.com/posts/HpBhpRQCFLX9tx62Z/where-is-the-capital-an-overview

---

Narrated by TYPE III AUDIO.

---

…

continue reading

When economists talk about “capital assets”, they mean things like roads, buildings and machines. When I read through a company's annual reports, lots of their assets are instead things like stocks and bonds, short-term debt, and other “financial” assets - i.e. claims on other people's stuff. In theory, for every financial asset, there's a financial liability somewhere. For every bond asset, there's some payer for whom that bond is a liability. Across the economy, they all add up to zero. What's left is the economists’ notion of capital, the nonfinancial assets: the roads, buildings, machines and so forth.

Very roughly speaking, when there's a net increase in savings, that's where it has to end up - in the nonfinancial assets.

I wanted to get a more tangible sense of what nonfinancial assets look like, of where my savings are going in the physical world. So, back in 2017 I pulled fundamentals data on ~2100 publicly-held US companies. I looked at [...]

---

Outline:

(02:01) Disclaimers

(04:10) Overview (With Numbers!)

(05:01) Oil - 25%

(06:26) Power Grid - 16%

(07:07) Consumer - 13%

(08:12) Telecoms - 8%

(09:26) Railroads - 8%

(10:47) Healthcare - 8%

(12:03) Tech - 6%

(12:51) Industrial - 5%

(13:49) Mining - 3%

(14:34) Real Estate - 3%

(14:49) Automotive - 2%

(15:32) Logistics - 1%

(16:12) Miscellaneous

(16:55) Learnings

---

First published:

November 16th, 2025

Source:

https://www.lesswrong.com/posts/HpBhpRQCFLX9tx62Z/where-is-the-capital-an-overview

---

Narrated by TYPE III AUDIO.

---

680 에피소드

모든 에피소드

×플레이어 FM에 오신것을 환영합니다!

플레이어 FM은 웹에서 고품질 팟캐스트를 검색하여 지금 바로 즐길 수 있도록 합니다. 최고의 팟캐스트 앱이며 Android, iPhone 및 웹에서도 작동합니다. 장치 간 구독 동기화를 위해 가입하세요.